UNI is proud to present the NDP Quarterly Price Report, covering the final three months of 2020. It is compiled from an analysis of real-time transactions executed on the UNI platform by 120 leading diamond trading companies from around the world, which collectively hold about $2 billion worth of inventory at any point in time.

POLISHED DIAMOND PRICES SHOWED MODERATE BUT STEADY GAINS DURING FINAL QUARTER OF 2020

FEBRUARY 24, 2021

The new year started on a relatively positive note, with price movements recorded during the period of October through December 2020 providing reasons for optimism. Retail demand trended positively, having first been propped up by an uptick in consumer optimism with the relaxation in COVID flight restrictions during the third quarter, and then healthy holiday season demand, which helped stabilize and ultimately improve average prices for diamonds.

Prudent upstream strategies by De Beers and Alrosa, which reduced pressure on diamond manufacturers while protecting the price of rough diamonds, coupled with marketing initiatives by the Natural Diamond Council, which focused on the need to reinforce personal relationships during times of stress and crisis, helped mitigate stress in the pipeline while fueling consumer demand. This restored a sense of calm in the diamond industry.

On average, price changes during the quarter were moderate but in a positive direction.

The average price of Round Diamonds increased by 0.79%, while the average price of Fancy-Cut Diamonds rose by 1.15%. As expected, the growth was not uniform in either of the two categories, with quite significant differences in the various size groups within each category.

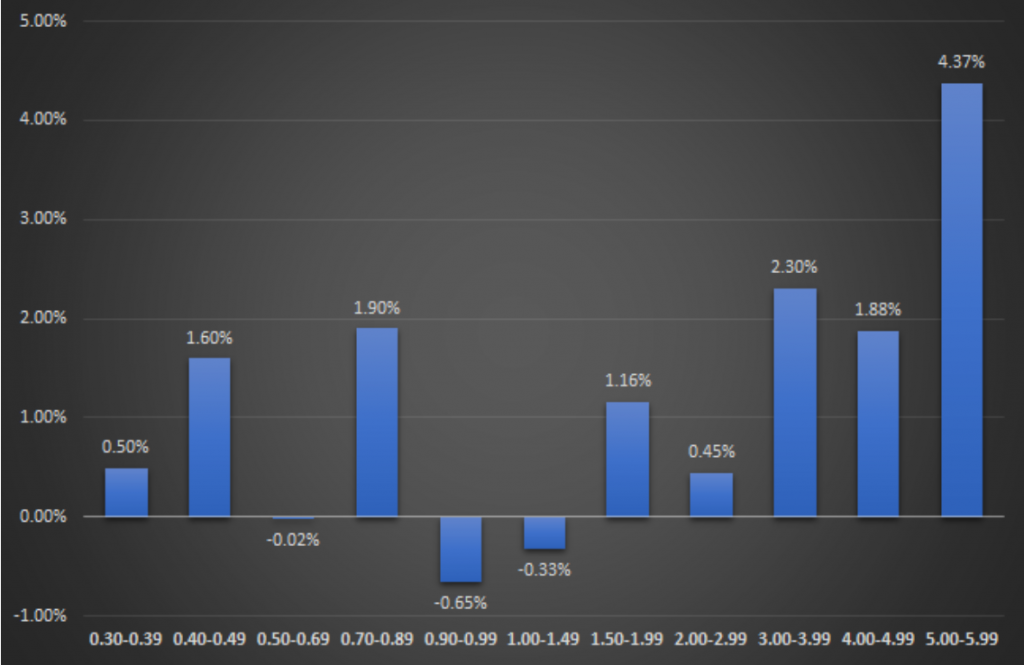

The chart below shows the appreciation or depreciation per size group for Round stones:

The categories showing the largest price gains included smaller stones and 5-caraters, while 4-caraters fell by 2.75% on average. Prices in the popular 1-carat category improved only slightly, by 0.21%.

The highest growth in Fancy-Cut Diamonds was registered in the larger stone categories, with 5-ct stones showing a whopping 4.37% appreciation.

With Fancy-Cut Diamonds, the picture was quite different:

As we dig deeper into the numbers, we see sometimes volatile price adjustments in the various color and clarity groups. The heatmap below tracks these price movement for goods in the 1ct to 1.499ct segment:

As the heatmap indicates, higher color/clarity combinations showed strong growth, while lower colors and clarities tended to decline in value.

More detailed information about the movements of diamond prices within each category can be found on NDP’s web portal (https://www.naturaldiamondprices.com) or on UNI’s platform (www.UNI.diamonds).

***

About UNI:

UNI is a fintech company focused on the international diamond industry. Partnering and acting on behalf of many of the sector’s most important natural polished diamond manufacturers, UNI’s groundbreaking business model has transformed it into one of fastest growing firms in the industry. Providing financing, online and offline sales and logistics services and solutions, and in-depth industry intelligence, UNI is the only company worldwide with the infrastructure and logistical capacity to aggregate and consolidate any size of diamond demand from multiple suppliers, evaluate and carry out quality checks for retail clients (or ship the goods to the retailer/jewelry manufacturer and allow them to do this), and then complete the sales and secure delivery process through to the final buyer. Operating on a transparent digital platform, UNI aims to enhance trust and confidence in the diamond industry globally.