Prices fluctuate; like waves in the ocean, they move up and down. At UNI, having precise pricing information from more than 30% of the industry, we are constantly monitoring market prices. We see it as our mission to make diamond pricing transparent, continuous and show how and why prices behave the way they do.

Today, we will take a look at diamonds as an investment vehicle and see what yield a diamond investment would produce in the last 6 months. We will be looking at 1ct Round diamonds with excellent polish, symmetry and cut (3EX) and no Fluorescence.

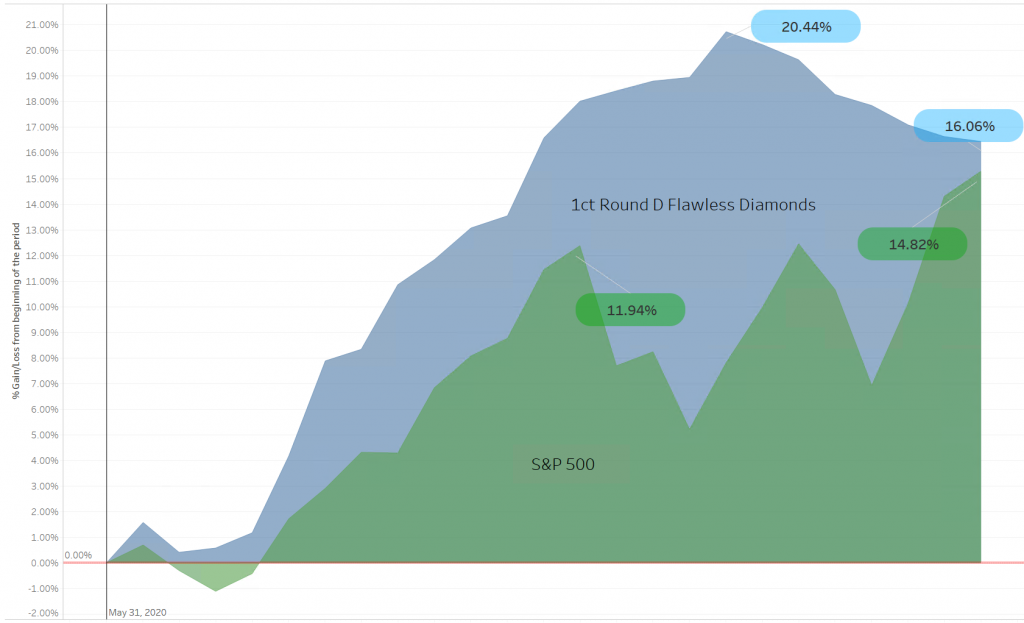

We will consider goods in the top five colors (D,E,F, G and H) and various clarities. We will start with returns on Flawless goods:

So, an investor who invested in D FL diamonds in May made a 20% gain by the end of September, or 16% gain by the time of this writing. Not bad, considering that S&P 500 made around 15% during the same period (May 31 till Nov 20). G FL goods also performed well, with a solid 8% gain. Lower color showed lower returns, averaging at around 5%. Time and again, flawless goods prove to be an excellent investment.

The next category is VVS diamonds (we combine VVS1 and VVS2 together for this analysis)

Unlike Flawless goods, D color was not the top performer. By the end of the period, E, F and G colors showed gains of 8.70%, better performance than D. Actually, by now D and H are at the bottom of the table with slightly over 5% gains.

The picture in VS clarities (again, VS1 and VS2 combined) is similar and somewhat more homogenic. Again, E,G and F are the leaders, while D and H color lag a bit behind. All however show solid returns of over 7%.

SI and I goods show lower returns and even losses in some of the categories.

An investor buying Included goods in F, G and H color would incur a loss of 2 to 6%.

Diamonds are objects of beauty and perfection that bring joy and love to our lives, but they are also an investment vehicle that a savvy investor can leverage and make significant gains. The analysis above shows how investment in best quality goods paid off handsomely in the past 6 months. The chart below speaks for itself – investment in diamonds outperformed S&P at any point in time over the past 6 months.

It’s time to invest in Diamonds! It is an emotional investment that can be worn, adorned and over time provide gains that can be beneficial for those who love a new asset class.

****

Want to get access to our Data Platform or perform a custom research? Contact us at data@uni.diamonds.

Disclaimer: The information in this report is based on UNI’s data repository that contains actual pricing and availability from over 90 manufacturers and wholesalers around the globe, with combined value of over $1.6B. The information is provided as-is, without any warranties express or implied, and should not be construed as investment advice.